A guide to buying a home during divorce

Getting started: what you need to know

People buy a new home during divorce for many reasons, including:

- Stability and independence: A new home can help you create a stable, fresh environment where you can regain your independence.

- A new beginning: Moving into a different space can symbolize a fresh start, allowing you to move forward with optimism.

- Investment in your future: Property is often a solid long-term investment, offering both financial security and personal growth.

Step-by-step guide to buying your new home

Step one: assess your finances

Before you start, take a close look at your income, savings, and any debts. This will help you figure out what’s possible. It’s also important to create a budget and factor in your new living expenses alongside other home buying costs. It's important to feel comfortable with your budget.

Finances checklist:

- Credit check: Get a clear understanding of your credit score and improve it if needed.

- Mortgage pre-approval: Find out how much you can borrow by securing a mortgage pre-approval. This will give you an idea of your budget.

- Plan your deposit: Consider how much you can afford for a down payment, especially if the sale of your marital home will contribute.

- Separation Agreement: Explore having a Separation Agreement drafted to have your financial arrangements legally documented. A Separation Agreement is useful if it’s too early to apply for a consent order (ie. before you receive the conditional order during the divorce process). This is a good idea if you’re buying or selling property and want to record this ahead of your consent order. amicable offer a fixed price Separation Agreement drafting service which can be bought separately or alongside any other service.

Talk to both a conveyancer and a Divorce Specialist early on. They’ll help you navigate the process smoothly and understand your options and rights regarding any existing property you may already own.

Step two: understand stamp duty relief

You may be eligible for stamp duty relief, which can reduce the costs of buying your new home. To qualify, you need to be legally separated or in the divorce process. A court order or separation agreement will be required.

Step three: find the perfect home

Once you’ve planned the logistics, it’s time to search for your perfect home. Here are a few things to think about:

- Location matters: Think about proximity to work, schools, and amenities that will make life easier for you.

- The right fit: Look for a home that meets your current and future needs within your budget.

Step four: make an offer

- Accurate valuation: Ensure the property is accurately valued before making an offer. Learn more about Sail Homes’ valuation services.

- Negotiation: Be prepared to negotiate the price and terms to secure the best deal.

Step five: legal and financial steps

- Conveyancing: Your conveyancer will guide you through the legal aspects of the home purchase, ensuring everything goes smoothly. Get conveyancing help from Sail.

- Finalising the mortgage: Work with your lender to finalize the mortgage agreement.

- Stamp duty relief: Make sure your conveyancer helps you claim any stamp duty relief you’re entitled to.

Tips for a smoother process

Communicate with your ex-partner

- Keep dialogue open: Open, respectful communication can help avoid unnecessary delays and stress.

- Get negotiation support: An amicable Divorce Specialist can help you resolve any disagreements around property as part of your separation.

Manage your expectations

- Set realistic goals: Understand that buying a home while divorcing can take time, and patience’s important.

- Prepare for delays: Things may not always go to plan, so have a backup plan ready.

After you’ve moved in

- Once you’ve purchased your new home, remember to update your legal documents, such as your will, to reflect your new situation.

Get help with the emotional journey

- Lean on others: Don’t be afraid to seek emotional support from friends, family, or professionals. amicable offers resources to help you through this process.

Buying a home during divorce doesn’t have to be overwhelming. With the right preparation, expert guidance, and support, you can make decisions that will help you build a new, secure, and positive future.

If you need personalised advice, don’t hesitate to contact amicable or Sail Homes for expert assistance.

Read More

-1.webp)

Divorce can be an emotional rollercoaster, and selling a property can add another layer of complexity. However, with the right information and support, you can navigate this challenge successfully.

-1.webp)

Like many things in life, the key to successfully getting back on your feet in the event of a divorce or separation is preparation and planning. Because everyone views partnership in different ways, and everyone views money in different ways.

-1.webp)

Normally, the biggest priority when a couple separates is sorting out where they will live and dividing any property. We understand that when you go through a divorce and property feels like something that must get sorted straight away; make sure you're emotionally ready to deal with it before jumping head-on into, what can seem like quite a complex process.

Start your amicable divorce journey

Speak to an amicable Divorce Specialist to understand your options and next steps for untying the knot, amicably.

Your guide to a kinder divorce

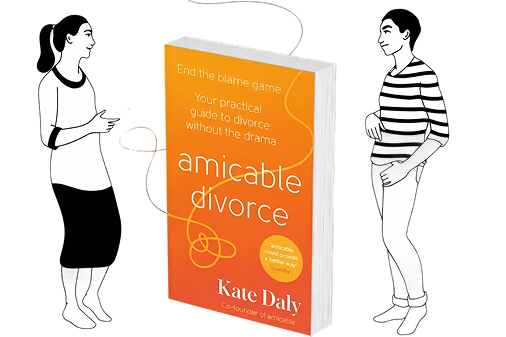

What if divorce didn’t have to be a battle?

In amicable divorce, Kate Daly offers compassionate, practical guidance to help you separate in a kinder, better way. Whether you’re just beginning, working through the practicalities or adjusting to co-parenting, this book meets you exactly where you are - and helps you move forward with confidence.

Pre-order on Amazon today

-2.webp)

Comments (0)