Changes to the rules around CGT and the impact on separating couples

The government has announced changes to the rules around Capital Gains Tax (CGT) in the Spring Finance Bill 2023.

In this blog, we'll look at how these changes impact divorcing and separating couples.

What is CGT?

CGT is the tax that's payable when a profit (gain) is made on a 'disposal' of an asset (property, stocks and shares or personal assets such as artwork).

Disposal in this context doesn't just mean selling, it can also include giving away or transferring the asset. Whereas CGT is payable on a gain in value, a loss in value is deducted from the gains made in the same tax year.

If you sell an asset to an individual who isn't your spouse/civil partner, there are CGT consequences.

The current rules

There's a 'spousal exemption' which means you do not pay CGT on assets you give or sell to your spouse or civil partner. Spouses can gift or sell assets to each other without triggering any gains. This is known as a 'no gain or no loss' basis.

Currently, if a couple separates, the spousal exemption (the ability to make CGT-free transfers between them) only extends to the end of the tax year in which they separate. The tax year is from 6 April to 5 April the following year. After that, transfers are treated as normal disposals for capital gains tax purposes.

The new rules

Following the Spring Finance Bill 2023 in March, couples will be given longer to transfer assets between them without capital gains tax (CGT) consequences.

Under the new rules, the spousal exemption will be available for up to three years after the end of the tax year of separation, or an unlimited time when the assets are transferred as part of a formal divorce agreement. This applies to disposals made on or after 6 April 2023.

Before the 6th of April, if you've already separated your assets, the old rules apply. After the 6th of April, if you've yet to separate your assets, the new rules apply.

This means that separating couples have more flexibility and time for planning in terms of reaching an agreement over their money, property and other assets as they separate.

What defines separation in terms of CGT?

There are three ways you can be ‘separated’ in terms of CGT:

- Court order - separated under a court order

- Deed of separation - separated under a formal deed of separation

- Factual separation - you’re separated and the separation is ‘likely to be permanent’

We teamed up with Evelyn Partners to help you understand the changes to CGT and how this will impact your divorce or separation. Watch the six-part Q&A here.

We work with couples together, to help them negotiate a fair financial settlement and make arrangements for their children if they have them. Book your free consultation to understand your options and the process.

Read More

Answer a few quick questions to get matched with the service that's right for you.

In this episode, Kate is joined by Jamie Cole, the co-founder of Sail Homes and Sail Legal, and Edwina Homfray-Davies, a Licensed Conveyancer with over 20 years of experience and part of Sail Legal, to discuss the most common property and divorce FAQs.

Around 22% of couples who live together aren’t married or in a civil partnership. Many people think they automatically gain rights to their partner's property and belongings if they live together for a long time.

Start your amicable divorce journey

Speak to an amicable Divorce Specialist to understand your options and next steps for untying the knot, amicably.

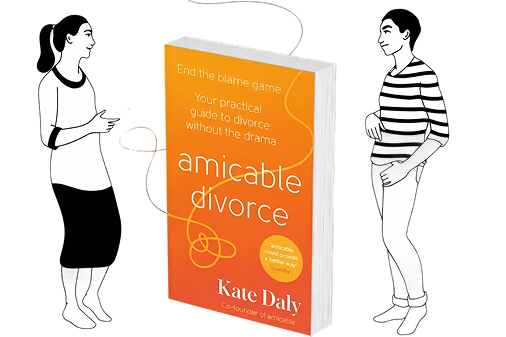

Your guide to a kinder divorce

What if divorce didn’t have to be a battle?

In amicable divorce, Kate Daly offers compassionate, practical guidance to help you separate in a kinder, better way. Whether you’re just beginning, working through the practicalities or adjusting to co-parenting, this book meets you exactly where you are - and helps you move forward with confidence.

Pre-order on Amazon today

Comments (0)