How to divide a business in a divorce

Dividing money and property during a divorce can be challenging, especially when there are complex assets like a business to discuss.

Business assets can be difficult to value, and there are many factors to consider when deciding how to divide them fairly. If you or your ex-partner own a business, this can add another layer of complexity to your divorce settlement. However, with the right approach and professional guidance, reaching an agreement is possible while ensuring the business can continue to thrive.

How is a business valued in divorce?

Determining its value is the first step in dividing a business during a divorce. This can be difficult as businesses aren’t always straightforward to assess, especially if they involve significant intangible assets like goodwill, intellectual property, or future earning potential.

There are several methods used to value a business in the context of divorce:

- Asset-based valuation: This method calculates the value of the business based on its assets minus any liabilities. It's often used for businesses with significant physical assets, like real estate or machinery, but might not fully capture the value of a business with substantial intangible assets.

- Income-based valuation: This approach considers the business’s profitability, projecting future income and discounting it to present value. It’s commonly used for service-based businesses where future earnings are a critical part of the value.

- Market-based valuation: This method looks at the sale prices of similar businesses in the market. While it can provide a useful benchmark, it’s important to note that market conditions can vary, and finding comparable businesses can be challenging.

- Hybrid approach: Often, valuers use a combination of methods to get a more accurate picture of the business's value, taking into account both tangible and intangible assets.

To ensure the valuation is fair and comprehensive, it’s advisable to hire an independent expert who specialises in business valuations for divorce. This expert can help you both understand the true value of the business and reduce the risk of disputes later in the process.

Approaches to dividing a business

Once the business has been valued, the next step is to decide how it will be divided. There are several options available, each with its own implications.

1. Selling the business and dividing the proceeds

One of the simplest solutions is to sell the business and divide the proceeds. This approach ensures a clean break and a clear financial outcome for each of you.

However, selling the business may not always be the best option, particularly if the business is a significant source of income or holds personal significance to one or both of you.

- Pros: Provides a clear and straightforward division of assets, eliminates future financial ties, and can be completed relatively quickly if there’s a buyer.

- Cons: May not reflect the business’s full potential value if sold in a hurry, and can lead to loss of income.

2. One spouse buys out the other

Another option is for one spouse to buy out the other’s share of the business. This allows the business to continue operating under the ownership of one spouse, while the other receives a fair share of its value.

- Pros: The business can continue operating without disruption, and the buying spouse retains control. The selling spouse receives a lump sum or structured payment, providing financial security.

- Cons: The buying spouse may need to secure financing or liquidate other assets to afford the buyout, which can be challenging. There’s also a risk of future disputes if the business’s value increases significantly after the buyout.

3. Co-ownership arrangements

In some cases, ex-spouses may choose to continue co-owning the business. This arrangement is typically only feasible if the divorce is amicable and both people are committed to working together professionally.

- Pros: Allows both people to retain their investment in the business, and can be financially beneficial if the business is thriving.

- Cons: This can lead to ongoing conflict if personal issues interfere with business decisions. Clear agreements on roles, responsibilities, and profit-sharing are essential to avoid future disputes.

4. Offsetting the business against other assets

Another approach is to offset the value of the business against other marital assets. For example, one spouse may retain full ownership of the business in exchange for the other receiving a larger share of property or savings.

- Pros: Provides flexibility in dividing assets, allows the business to continue without disruption, and can lead to a fairer overall settlement.

- Cons: Requires a careful assessment of all marital assets to ensure fairness, and may not be viable if there aren’t enough other assets to offset the business value.

Factors to consider when dividing a business

When deciding how to divide a business, several factors should be taken into account:

- Contributions of each spouse: Consider the contributions each spouse has made to the business, both financially and in terms of time and effort. Even if one spouse wasn’t directly involved in day-to-day operations, their support may have been crucial to the business’s success.

- Future earning potential: Assess the future earning potential of the business and how it might impact both of your financial futures. This is particularly important if one spouse is buying out the other’s share or if the business is a significant source of income.

- Impact on children: If the business provides stability or income that benefits your children, consider how different division methods might impact them. For example, selling the business could disrupt their lives, while co-ownership might provide continuity.

- Tax implications: Be aware of the tax implications of any division method. Selling a business, transferring ownership, or receiving a buyout can all have significant tax consequences, which should be factored into the final decision.

Dividing a business during a divorce is challenging, but with thoughtful consideration and professional guidance, it’s possible to reach an agreement that is fair and practical for you both.

At amicable, we’re here to help you navigate this complex process, ensuring that your business and your financial future are secure as you move forward. You can get help planning your finances here or book your free 15-minute advice call to discuss the best option for you in dividing the business in your divorce.

FAQs

Can my ex take half of my business in a divorce?

While the starting point for dividing marital assets in the England and Wales is 50/50, this doesn’t necessarily mean your ex will receive half of your business. The court considers various factors, including each spouse’s contribution to the business, the overall financial situation, and the needs of both people. The goal is to reach a fair outcome, which may involve one spouse retaining the business while the other receives a greater share of other assets.

Can I keep the business if it was started before the marriage?

If the business was started before the marriage, it might be considered separate property, particularly if your spouse didn’t contribute to it. However, any increase in the business’s value during the marriage could be considered marital property. It’s essential to consult with a legal professional to understand how the law applies in your situation.

How is a business valued during a divorce?

A business is typically valued using one or more of the following methods: the market approach (comparing similar businesses), the income approach (projecting future earnings), or the asset-based approach (calculating net asset value). Or a hybrid of these methods is used. Engaging a professional business valuator is essential to ensure an accurate and fair valuation.

What happens if my ex and I disagree on the business valuation?

If you and your ex can’t agree on the business’s value, you may need to engage a neutral third-party expert to provide an independent valuation. In some cases, each party might hire their own expert, and the court will decide which valuation to use, or the experts will work together to reach a consensus.

What happens if my ex and I can’t agree on how to divide the business?

If you and your ex can’t reach an agreement on how to divide the business, the court may step in to make a decision. This could result in one spouse being awarded the business and the other receiving a share of its value, or the court may order the business to be sold and the proceeds divided. Court intervention should be a last resort, as it can be time-consuming, costly, and result in an outcome that neither of you is entirely happy with.

Can we continue to run the business together after the divorce?

Yes, some ex-spouses choose to continue running the business together, particularly if they have a good working relationship. However, it’s essential to establish clear roles, responsibilities, and profit-sharing agreements to prevent future conflicts. If you’re considering this option, a legal agreement outlining the terms of co-ownership is highly recommended.

Read More

In this episode, Kate is joined by Jamie Cole, the co-founder of Sail Homes and Sail Legal, and Edwina Homfray-Davies, a Licensed Conveyancer with over 20 years of experience and part of Sail Legal, to discuss the most common property and divorce FAQs.

Dividing farms and land during a divorce can be complicated.

Like many things in life, the key to successfully getting back on your feet in the event of a divorce or separation is preparation and planning. Because everyone views partnership in different ways, and everyone views money in different ways.

Start your amicable divorce journey

Speak to an amicable Divorce Specialist to understand your options and next steps for untying the knot, amicably.

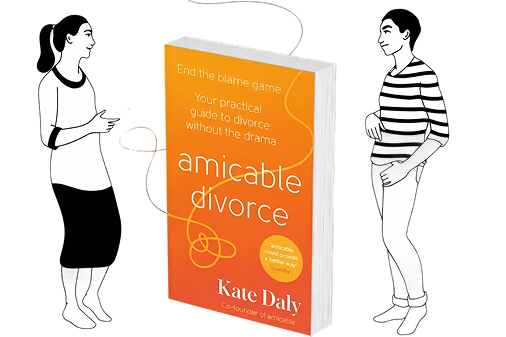

Your guide to a kinder divorce

What if divorce didn’t have to be a battle?

In amicable divorce, Kate Daly offers compassionate, practical guidance to help you separate in a kinder, better way. Whether you’re just beginning, working through the practicalities or adjusting to co-parenting, this book meets you exactly where you are - and helps you move forward with confidence.

Pre-order on Amazon today

.webp)

Comments (0)