What is financial abuse and how to prevent it from happening during a divorce?

There are more and more conversations taking place around financial abuse, and each year we see greater changes in this area. Slowly, but surely.

But do people truly understand the life-changing impact financial abuse has on individuals who experience it?

What is financial abuse?

"Financial abuse is a form of domestic abuse, whereby the abuser restricts, exploits or sabotages their partner’s financial resources."

Now, let’s be clear here. When I say partner, this can mean current partner, ex-partner, family member or friend. Quite frankly, financial abuse can take place in any relationship, at any time. And in the case of divorce, it can take place during the process, after, and way down the line in some cases.

For a more specialist, in-depth look at financial abuse during divorce, listen to this episode of The Divorce Podcast where Kate Daly, Co-founder of amicable, was joined by financial abuse specialist, Michelle Hoskin, to discuss financial and economic abuse during a divorce.

What are the signs and symptoms of financial abuse?

Well, you won’t be surprised to hear that it’s all about controlling behaviour. An abuser uses their powers of coercion to gain control over their partner, which can involve the victim/survivor becoming isolated and deprived of what they need. With their finances, or freedoms, restricted or removed, the victim/survivor is left with very little choice but to stay.

In many cases of separation and divorce, it does not stop there. The abuser’s aim is to reduce their partner to the point of total deprivation and desperation, meaning that it’s incredibly difficult for them to rebuild their lives after the relationship is over.

Is financial abuse a crime?

'Economic abuse', specifically, is now defined in the Domestic Abuse Act 2021 and is a criminal offence. Economic abuse includes financial abuse plus the control over other resources that we all need to thrive and survive. Such resources can include access to food, housing, technology (to work), transport, personal hygiene products and clothing.

How many people face economic, financial or material abuse?

Well, we know that:

- 1 in 5 women and 1 in 7 men have experienced financial abuse. (FCA)

- 8.7 million people report experiencing economic abuse. (Refuge)

- • 1.6 million people saw this begin because of the COVID-19 pandemic. (Refuge)

The numbers are shocking, and I suspect, no way near high enough, as I know 3 people personally who themselves have fallen victim to such controls – each of them has never reported it.

There are lots of factors to economic and financial abuse, but here are just some of them:

- It often occurs alongside another form of abuse, such as physical, sexual or psychological abuse.

- It is designed to create economic instability or make someone financially dependent.

- It limits freedom.

- It is difficult to leave an abuser.

- The victims/survivors struggle to rebuild their lives afterwards.

Financial abuse signs and indicators

People ask how we can identify that financial and economic abuse is occurring. Abuse can take different forms, but here are a few signs to look out for:

- The abuser controls what the victim/survivor spends, asking for receipts.

- The abuser insists on money going into a joint bank account, or other account that the victim/survivor doesn’t have access to.

- The abuser takes the victim’s/survivor’s salary, so they have no money for themselves.

- They make the victim/survivor ask for money and use it as a bargaining tool.

- They spend money on credit in the victim’s/survivor’s name.

One of our own clients, who is a Certified Financial Abuse Specialist™ – we will call her Samantha – shared her story with us:

"I did not realise I was experiencing financial abuse. When I was in my relationship for 7 years, we had a joint bank account. I was in charge of all the finances, and he would just take money out as and when he pleased, this sometimes [coming out of] my wage.

When I left him, he refused to sell, pay or leave our joint mortgage property. Due to this, I had no choice but to let it go into repossession. This took years to do, with a lack of support from the bank. Finally, it’s completed but my credit scoring is so low, I cannot even get a phone contract in my own name. I know many survivors who are struggling with financial abuse and the impacts they have. However, it is not spoken about as largely as other forms of abuse."

The truth is, financial and economic abuse are real. If you relate to any element of the above, then you must speak out. Speak to a friend, a colleague at work, a family member or even one of the amazing groups and associations who are supporting victims/survivors every day. Helpful guidance can be found here.

With each year, we are seeing small changes to help victims/survivors move on with their lives after financial abuse. These include financial institutions writing off debt, educating victims/survivors about finances, helping victims/survivors back into employment, and getting them the support they need. Banks have started to show big improvements in the UK: information can be found on your bank’s website as to what they can do to support you. However, there is still a lot that needs to be done, so that people like Samantha can rebuild their lives.

These forms of abuse can happen to anyone – any gender, any social class, any religion … anyone!

The more we talk about it, the more we will be doing to stop it. It is not okay. Nobody has the right to restrict, exploit or sabotage your access to whatever you need to thrive in your life.

The Standards International policy and resources on financial abuse spells out our commitment to tackling this issue. Our policy contains valuable resource links, information, support, and assistance for victims of financial abuse.

The Financial Abuse Specialist Certification™ is a course of online learning and a final assessment designed to demonstrate your knowledge. Certified status is a unique global mark of best-practice excellence and a beacon of hope for victims/survivors who need it most.

Help and resources to report financial abuse

UK

- Surviving Economic Abuse

- Women’s Aid

- Refuge

- Hourglass – a charity aiming to end harm, abuse and exploitation of older people in the UK

- Age UK

- UK Government – Report abuse of an older person

- Respect Men’s Advice Line

- Fair Result – divorce support

- The Group Hug – divorce and separation support forum

International

- Womens Law (USA)

- Canadian Bankers Association (Canada)

- 1st For Women (South Africa)

- 1800 Respect (Australia)

FAQs

Is it worth reporting financial abuse to the police?

Yes, financial abuse is a crime, and you should report it to the police. Not only will they be able to take action, but they can also provide you with the next steps and advice, and if necessary, refer you to local and national helplines and resources that can offer support during this difficult time.

How to prove financial abuse? (UK)

There are some telltale signs that financial abuse is occurring, and you must seek help. Some examples of financial abuse include: Partner A controlling what Partner B spends, asking for receipts; Partner A insists on money going into a joint bank account, or other account that Partner B doesn’t have access to; Partner A takes Partner B’s salary so they have no money for themselves; Partner A makes Partner B ask for money and use it as a bargaining tool. These are just a few examples, but financial abuse can be abstract.

Is financial abuse grounds for divorce?

Since April 2022, in England and Wales, marital or civil partners are no longer required to provide ‘grounds for divorce’, and this extends to financial abuse. Essentially, you can apply for a divorce without needing to give a reason for the breakdown of the marriage. The only requirements are that you have been married for a year and that your marriage is legally recognised in the UK.

Read More

In this blog, we will discuss the different options available and things some legal topics which might cause confusion (ie. the ‘no-order principle’).

In this blog, we look at the Budget's impact on divorce, separation and dividing money and property as part of a separation.

-2-3.webp)

For separating couples who are also homeowners, dividing their property tends to be one of their biggest priorities when making financial arrangements.

Start your amicable divorce journey

Speak to an amicable Divorce Specialist to understand your options and next steps for untying the knot, amicably.

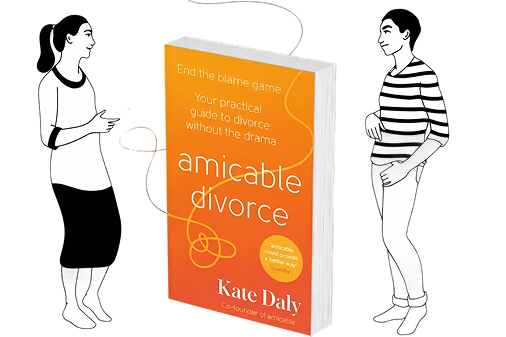

Your guide to a kinder divorce

What if divorce didn’t have to be a battle?

In amicable divorce, Kate Daly offers compassionate, practical guidance to help you separate in a kinder, better way. Whether you’re just beginning, working through the practicalities or adjusting to co-parenting, this book meets you exactly where you are - and helps you move forward with confidence.

Pre-order on Amazon today

.webp)

.webp)

Comments (0)